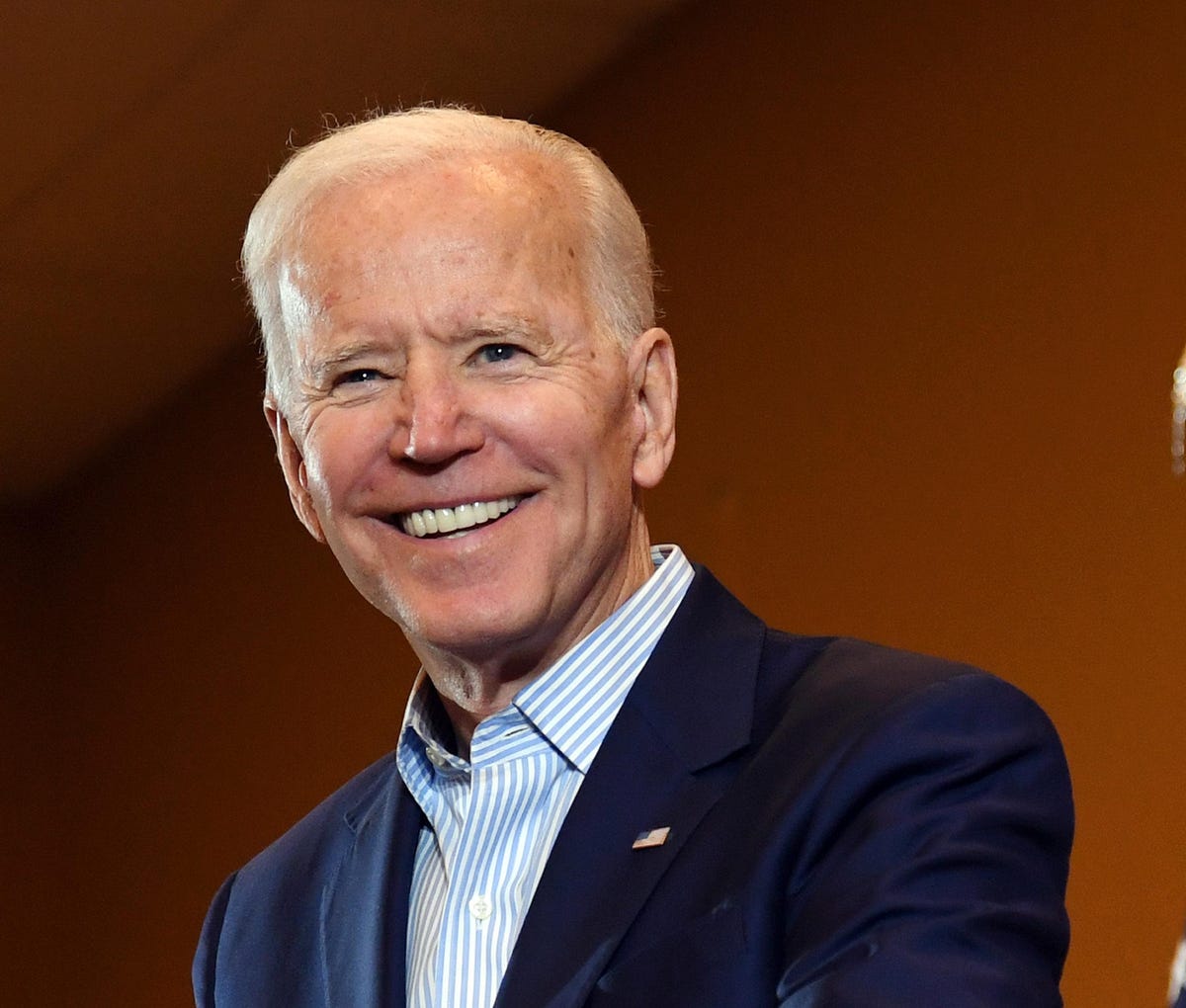

President Joe Biden (Photo by Ethan Miller/Getty Images)

Getty Images

Here are 5 reasons why President Joe Biden hasn’t cancelled student loans.

Here’s what you need to know.

Student Loans

Did student loan cancellation get cancelled? It certainly feels that way to some student loan borrowers. Any hope for wide-scale student loan cancellation hasn’t materialized in the first eight months of the Biden presidency. Here are 5 potential reasons why Biden hasn’t cancelled your student loans:

1. Biden doesn’t have the legal authority to enact student loan cancellation

Biden supports student loan cancellation up to $10,000, but he has said repeatedly he doesn’t believe he has the legal authority to enact wide-scale student loan cancellation. Biden wants Congress — which is the federal branch of government that controls spending — to pass legislation that would cancel student loan debt. Biden has said he would sign any legislation on student loan forgiveness that Congress passes. Biden, like fellow Democrat Speaker of the House Nancy Pelosi (D-CA), believe in the separation of powers between the legislative (Congress) and executive (the president) branches of government. Sen. Elizabeth Warren (D-MA) and Senate Majority Leader (D-NY) wholeheartedly disagree that the president can’t unilaterally cancel student loans. They interpret the Higher Education Act of 1965 as empowering the president (through the U.S. Secretary of Education) to cancel an unlimited amount of student loan debt for an unlimited amount of student loan borrowers. However, while the president has some authority to cancel student loans, the Higher Education Act doesn’t explicitly state that Congress empowers the president with an unfettered right to cancel everyone’s student loan debt an unlimited amount of times. It’s also unlikely that Congress abdicated full control of student loan forgiveness to the president and unilaterally removed its constitutional control over federal spending in this sphere.

2. Student loan forgiveness legal memo doesn’t say to cancel student loans

There was supposed to be a legal memo from the U.S. Department of Education to the president with a legal analysis of the president’s ability to enact wide-scale student loan cancellation without further authorization from Congress. It’s unclear if this memo has been finalized or presented to the president for review. It’s also unclear what recommendations are included in the memo or whether such analysis will be released publicly. Therefore, absent the U.S. Department of Education advising the president that it’s lawful for the president to enact wide-scale student loan cancellation, there’s no clear legal path for the president to act. Importantly, even if the Education Department says the president can proceed with student loan forgiveness, there’s no guarantee that Biden will cancel student loans. That said, this doesn’t mean that Biden’s next step on student loans is only about Biden’s legal ability to cancel student loans. Biden could still disagree or weigh other policy and political considerations that could dictate an alternative course of action.

MORE FOR YOU

3. Biden is focused on targeted student loan cancellation

Even without wide-scale student loan cancellation, Biden has cancelled more student loan debt than any other president in U.S. history. (Here’s what Biden student loan forgiveness means for your student loans). Since becoming president, Biden has cancelled nearly $10 billion of student loans through targeted student loan cancellation, which is student loan forgiveness for specific groups of student loan borrowers. Most recently, Biden has focused on student loan cancellation under existing law for disabled student loan borrowers and borrowers whose college or university misled them under the borrower defense to repayment rule. (Find out here if you qualify for $9.8 billion of student loan forgiveness). Expect targeted student loan cancellation to continue, with Biden pursuing a piecemeal approach to student loan forgiveness rather than implement wide-scale student loan cancellation for every student loan borrower.

4. Student loan relief is ending

Temporary student loan forbearance will end January 31, 2022. This means that effective February 1, 2022, federal student loan borrowers will start to pay student loans again at their normal interest rate. It also means that collection of student loan debt in default will resume as well. This may sound like a good time to cancel student loans, given the financial reality that millions of student loan borrowers will face. For example, Warren has said student loan borrowers aren’t ready to start paying student loans and need until at least March 31 before student loan repayment resumes. Warren also says student loan servicers aren’t ready for student loan borrowers to resume student loan payments. The Biden administration is sensitive to these concerns, but also wants to champion an economic recovery in the wake of the Covid-19 pandemic. Student loan cancellation sends 3 messages. One potential message is that if the economy is recovering, why is there a need to cancel student loan debt at a potential cost of up to $1 trillion? Supporters of student loan forgiveness say it’s essential financial relief that will help a generation of student loan borrowers achieve financial freedom, start a family, buy a home, save for retirement and achieve other life goals. (Here’s what Biden’s student loan forgiveness means for your student loans). At the same time, wide-scale student loan forgiveness may be perceived as conflicting with the message of an economic recovery. Can the economy recover and student loan forgiveness gets implemented? Yes, but it’s a tougher sell in Congress and to the public. (Here’s how to get student loan forgiveness).

5. Student loan cancellation will be more than $110 billion

In addition to the nearly $10 billion that Biden has cancelled as president, student loan borrowers will get an additional $110 billion of student loan cancellation by January 31, 2022. Why? In March 2020, Congress passed the Cares Act, the $2.2 trillion stimulus package, which paused federal student loan payments and temporarily set interest rates on federal student loans to 0%. The U.S. Department of Education estimates this saved student loan borrowers approximately $5 billion per month. The Cares Act was set to expire after six months on September 30, 2020. However, President Donald Trump renewed this student loan relief twice until January 31, 2021. Biden also extended this student loan relief twice through January 31, 2022, when it will expire permanently. In aggregate, student loan borrowers will get more than 22 months of no mandatory student loan payments, which will result in $110 billion in student loan cancellation. Biden has cancelled a total of $70 billion of student loans. Opponents of wide-scale student loan cancellation say this is a substantial amount of student loan forgiveness. Supporters of wide-scale student loan cancellation say it’s a tiny fraction of the $1.7 trillion of student loan debt outstanding. Student loan cancellation has become a focus in Congress. However, if the temperature in Congress is any indication, there’s no current plan to pass any legislation for wide-scale student loan cancellation — even with the Democrats in control of both the House and Senate.

If you have student loans, don’t expect wide-scale student loan cancellation. With student loan relief ending soon, make sure you are fully prepared for student loan repayment to restart. Understand all your options. Here are some popular ways to save money: