Facade with sign and logo at Game Stop video gaming store in Dublin, California, August 23, 2018. … [+]

Gamestop Corp.

Earnings Preview:

The company is expected to report a loss of ($0.22)/share on $1.19 billion in revenue. Meanwhile, the so-called Whisper number is a loss of ($0.46)/share. The Whisper number is the Street’s unofficial view on earnings.

A Closer Look At The Fundamentals:

The company’s earnings took a hit after March 2020 due to the Covid-19 lockdown. Earlier this year the stock soared and become the poster child for the meme-stock craze in Q1 2021. Since then, the stock has settled down but is still trading much higher than where it was this time next year. The company is expected to lose money in 2021, 2022, and 2023. Investors want to see some glimmer of hope for the price to stay at these lofty levels.

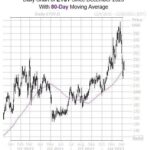

A Closer Look At The Technicals:

Technically, the stock is digesting a huge rally it saw at the end of 2020 and in early 2021. The bulls want to see the stock break above $255 and the bears want to see it beak down below support near $132. Until either level is breached, we have to expect this sideways action to continue.

MORE FOR YOU

Pay Attention To How The Stock Reacts To The News:

From where I sit, the most important trait I look for during earnings season is how the market and a specific company reacts to the news. Remember, always keep your losses small and never argue with the tape.