Saving looks like an unattainable hurdle while you’re struggling to make ends meet and need to seek for quarters below the sofa to pay your electrical invoice. I get it (I write for a residing, in any case—I’m not driving a Lamborghini).

Nonetheless, discovering methods to construct your financial savings and even begin investing is the one approach you’re going to get off the paycheck-to-paycheck battle bus.

Listed below are a number of methods you could possibly discover a number of additional {dollars} to avoid wasting each week

Purchase Low-cost Staple Meals in Bulk and Meal Prep

Meals is one in every of our most controllable month-to-month prices, in order that’s the place we’ll begin. Meal prepping—spending time in your days off to organize lunches and dinners for the week—is a good way to convey your meals prices down with out turning into malnourished on immediate ramen.

Meal prepping works properly for a number of causes: (A) you lower your expenses by cooking from scratch as a substitute of shopping for frozen dinners or takeout, (B) you save time by making and freezing a number of batches forward of time, and (C) you possibly can plan more healthy meals, as a result of being wholesome can also be good to your funds, by the best way.

Sometimes, the prices per pound go down while you purchase bigger quantities of staple meals. Begin by stocking your pantry with these substances:

- Rice (ideally brown)

- Dried beans

- Pasta (ideally wheat)

- Frozen veggies

- Lentils

- Oats

- Flour

- Oil

- Peanut butter

- Espresso when you drink it (less expensive to brew your personal)

When you’ve constructed a base of nonperishable staples, you possibly can complement with occasional journeys to the shop to replenish perishables. I’d additionally suggest constructing an arsenal of herbs and spices to make your flavors extra fascinating.

So far as recipes go, I repeatedly go to the subreddit EatCheapAndHealthy to get new concepts, however issues like oatmeal, pancakes, soup, burritos, curries, and stir-fries are very simple and low cost methods to start out. Study to bake your personal bread; it’s a rewarding talent to have and it’s truly enjoyable.

You may even attempt to duplicate your favourite takeout or fast-food orders—I exploit spaghetti to make a lo mein duplicate for 1/fifth the associated fee.

Turning your self right into a frugal grasp chef can also be a reasonably strong method to impress household/pals/dates, when you want additional convincing.

Audit Your Subscriptions

Recurring subscriptions will be one of many largest invisible drains to your checking account. In some instances, you could not even bear in mind you might have a subscription till you see the month-to-month or annual cost hit.

There are some things you are able to do to keep away from hemorrhaging subscription cash. First, repeatedly evaluate all costs in your debit or bank cards.

Not solely will this preserve you conscious of subscription funds; it’s additionally a superb behavior to examine for fraud when you see any purchases you didn’t truly make.

Second, don’t preserve a number of subscriptions with overlapping functions. Positive, you would possibly have already got saved cash by canceling cable and utilizing Netflix and Hulu as a substitute—however there may nonetheless be room for enchancment.

You might select one in every of them to maintain first and work via all the highest exhibits you wish to see, then cancel and swap.

Or, you can even check out among the free (and secure and authorized) streaming websites on the market, like Yahoo View, Crackle, Tubi, and Vudu. Choices will normally be extra restricted and you might have to cope with advertisements, but it surely’s extra money within the financial institution!

Lastly, it’d go with out saying at this level, however cancel any subscriptions that you just aren’t truly utilizing. It is likely to be Amazon Prime, a premium music service, {a magazine}, or a gymnasium membership you retain which means to make use of.

No matter it’s, funnel the associated fee into financial savings or investments as a substitute. It’s possible you’ll be shocked how a lot you’ll accumulate in a 12 months.

Purchase and Promote at Thrift Shops and Secondhand Websites

When it’s good to purchase one thing—from a winter coat to needed family items—it could possibly prevent a ton of cash to get them secondhand.

You may usually even rating name-brand objects in good situation for a fraction of the unique costs.

Some persons are in a position to herald additional earnings by reselling thrifted objects on-line, however this normally works greatest when you might have good foundational information of sure varieties of merchandise and may eyeball what’s going to promote and what received’t.

In any other case, you would possibly spend cash you don’t have on stock that simply sits round your own home.

Nonetheless, when you already have objects sitting round your own home, you would possibly as properly see what you possibly can promote. Uncluttering your residing house and including to your financial savings is a win-win.

Poshmark, eBay, and Fb Market are a number of locations the place you possibly can listing objects to promote.

Take into account Including Roommates

This isn’t a super choice for everybody, particularly when you already stay with different individuals or there are different causes stopping a transfer.

Nonetheless, when you’re actually struggling to make ends meet and are operating out of different choices, weigh the thought. It’s normally the case that the extra individuals you reside with, the cheaper prices develop into for everybody.

As an illustration, you may need the choice of renting a one-bedroom residence by your self for $750, or a $1500 four-bedroom place with three roommates.

With the primary choice, you’re paying $750 plus all utilities. With the second choice, your hire drops to $375, and also you share prices like heating and electrical.

Now, how nice this expertise is for you all depends upon the individuals you find yourself with. It looks like everybody has a horrible roommate story. Some by no means wash their dishes.

Others have the TV too loud at 2 a.m. Others simply don’t mesh properly sharing house. Nonetheless, you may also discover that you just take pleasure in residing with roommates and get alongside properly.

It may be a roll of the cube, however when you occur to finish up with a nasty roommate—so long as they’re not legitimately harmful or poisonous—take a deep breath and take into consideration the a whole lot of {dollars} you’re saving (and the longer term tales you’ll get to inform).

Use Free Money Again Apps At any time when Attainable

Know-how is fairly wonderful, particularly when it provides you cash without spending a dime. There are a number of varieties of apps you should utilize to earn money again while you do your common procuring, like getting groceries.

Scan your receipts with cash-back grocery apps

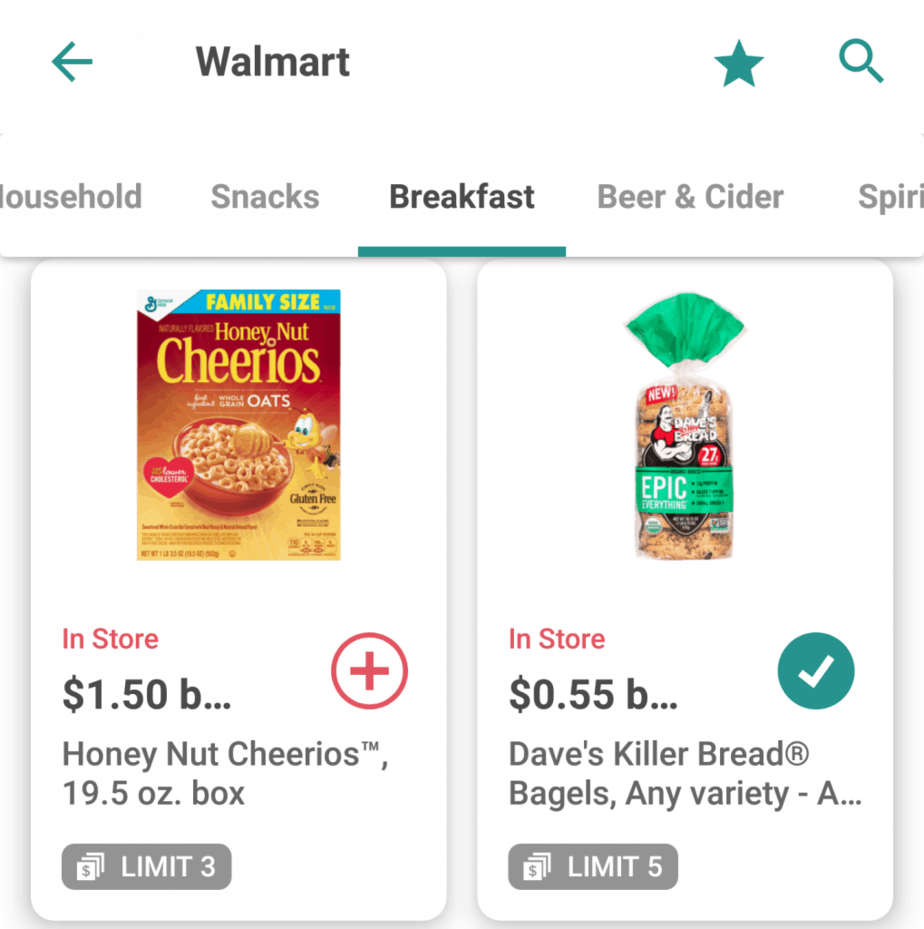

With every of those apps, you possibly can add objects to your in-app procuring listing and scan your receipt after you buy these objects. Then, money again or factors are added to your app account, which you’ll be able to normally money out to PayPal.

Ibotta (pictured left): This app is my favourite as a result of additionally they embrace common incentives like an additional $5 for redeeming 5 affords in every week. Join Ibotta right here and get $5 free.

Fetch Rewards: Scan receipts from any grocery retailer. Join Fetch Rewards right here and enter Fetch code K6AAK for two,000 sign-up factors.

Checkout 51: Type by retailer or class. Join Checkout 51 and get $5 free.

The very best half is that these apps function individually, so you should utilize all three without delay, even for a similar product.

I prefer to browse the affords whereas I’m on the gymnasium, on the bus, or watching TV, so it doesn’t add any additional time to my day.

Then, I add my receipts as quickly as I get residence from the grocery retailer. I money out a pair instances a 12 months and it’s at all times a pleasant bonus!

Get a refund for on-line purchases

Store via Rakuten to get a refund from a whole lot of shops. This consists of requirements like child provides and tires to your automotive. Join Rakuten right here and get $10 free.

Hyperlink playing cards to computerized cash-back apps

Of all these choices, this one is by far the simplest, as a result of it requires no additional work in your finish after you’ve arrange the apps.

With these apps, you securely join debit or bank cards, and everytime you make a purchase order at one of many app’s retail companions, you robotically earn money again.

Listed below are the 2 fundamental apps that work this manner:

Dosh: Companions embrace some grocery shops (e.g. 2% money again at Sam’s Membership), in addition to retail shops and eating places, each native and chains. Join Dosh right here and get $5 free while you hyperlink a card.

Drop: Far more restricted than Dosh, at the least for now. You may solely decide 5 shops to attach for computerized rewards. Join Drop right here.

I began utilizing each of those apps lately, however I like the idea of completely hands-off money again. Your first passive earnings stream!

Decide Up a Facet Hustle

So, perhaps you’ve slashed your bills so far as they will go, and also you’re nonetheless struggling to make ends meet. On this case, the one different choice for saving extra is to earn extra.

You may ask for a increase or additional hours at your fundamental job, or you should utilize your free time to start out a aspect hustle. I don’t suppose I can beat Peter’s aspect hustle concepts, so head to that article subsequent to start out brainstorming!

Different Methods to Discover Useful and Free Help for Folks and Households with Low Revenue

Kate is a author and editor who runs her content material and editorial companies remotely whereas globetrotting as a digital nomad. To date, her laptop computer has accompanied her to New Zealand, Asia, and across the U.S. (largely due to bank card factors). Years of analysis and ghostwriting on private finance led her to the FI group and co-founding DollarSanity. Along with touring and out of doors journey, Kate is captivated with monetary literacy, compound curiosity, and pristine grammar.