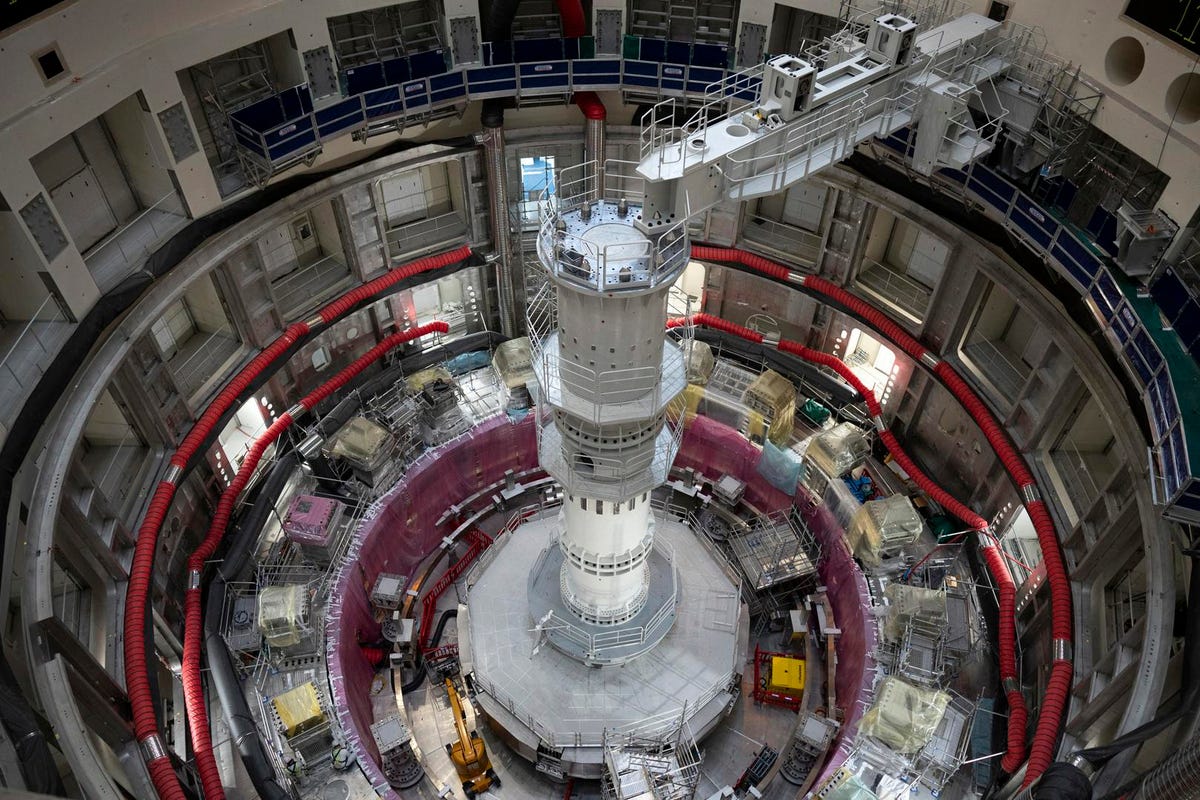

Inside the ‘Tokamak’ fusion reactor under construction at the ITER fusion project in France, Sept. 2021.

ASSOCIATED PRESS

Having raised more than $3 billion in 2021 from the likes of Bill Gates and Jeff Bezos, fusion developers insist this zero-carbon energy source could be a reality within a decade.

It’s clear that nuclear fusion can work at scale — just look at the stars. For 70 years physicists have dreamed of bottling that star power in the form of fusion reactors that would power the electric grid with the same limitless, zero-carbon reactions that make the sun shine. This Holy Grail has long been advertised as just 20 or 30 years away, but fusion fans have refused to give up the faith. And for good reason. Fusion (smashing together hydrogen atoms into helium) promises limitless zero-carbon electric power with zero risk of meltdown and virtually none of the radioactive waste associated with existing nuclear power plants that run on fission (the splitting apart of uranium atoms into smaller elements).

The dream inspired Ajay Royan, cofounder of Mithril Capital (with billionaire Peter Thiel), who in 2013 first invested $2 million in Redmond, Wash.-based Helion Energy so that it could build a prototype “repetitive pulse power” machine. Mithril has invested in Helion ever since, including its recent $500 million round (valuing the company at $3 billion) — with the promise of $1.7 billion more if the company’s seventh prototype works as hoped. Helion’s round was led by Sam Altman of Y Combinator.

The year of 2021 was a big one for both fusion financings and forecasts, as developers raised more than $3 billion to fund their next round of machines — with some now promising commercially viable fusion in just five years. Royan is happy to see fusion getting more attention; “Sure 2021 may be a turning point for fusion according to Google analytics, but the real turning point happened a decade ago when power electronics passed a threshold.”

CEO David Kirtley explains that the initial R&D work behind Helion was done in federal labs, out of which Helion was spun in 2013. Freed from the federal R&D bureaucracy, Helion has been building new prototypes one after another ever since. “The startup mentality is not nice to have, it’s a requirement. and what we have focused on from the beginning,” says Kirtley.

In 2020 Helion completed its sixth prototype reactor, dubbed Trenta. It’s now building a seventh, Polaris, while already designing the eighth, Antares, which Kirtley intends to be the first fusion machine ever to put out more energy than it takes in. Alongside fast iteration, Helion benefits from local expertise. Its building the Polaris machine in Everett, Wash., near Boeing’s biggest factories, where they can tap a welcoming ecosystem of contract engineers and precision manufacturers. Kirtley says they spend the mornings tinkering, updating systems, and powering up capacitors. “Every afternoon at 3 pm we start doing fusion.”

Helion cofounders Chris Pihl (L) and David Kirtley, in the lab.

Helion/Cory Parris

To understand Helion’s approach, first consider the magnetic repulsion that occurs when you try to force the positive poles of two bar magnets together. It’s the principle that enables “mag-lev” tech like Japan’s famous bullet trains, which utilize magnetic repulsion to float on a cushion of air.

Fusion researchers for decades have sought to devise the world’s strongest electromagnets, with which they engineer reaction chambers with magnetic fields so strong that they can contain, and compress, an injected stream of positively charged protons into a ball of plasma so hot that they fuse into helium.

In Helion’s novel system, the energy released in the fusion reactions continuously pushes out against its magnetic containment field, which pushes back — causing oscillations (“like a piston,” says Kirtley) that generate an electric current, which Helion captures directly from the reactor. (For more, read up on Faraday’s law of induction.)

Rendering of Helion’s fusion “engine.”

Helion

Royan of Mithril says perhaps the biggest attraction of Helion’s direct electricity generation method is its simplicity. Other fusion approaches aim to generate heat, in order to boil water and power steam turbines, which make electricity — like at traditional nuclear power plants. “We can do it with no steam turbines or cooling towers. We get rid of the power plant.”

To be sure, Kirtley understands fusion skepticism, especially around his aggressive timetable. He started his career in the fusion field, inspired by scientists at national labs in the 1960s who made big advances in magnetic containment (vying with Russian scientists to devise donut-shaped reactors called tokamaks) even before the invention of transistors. But Kirtley lost faith after determining early approaches just couldn’t evolve fast enough to yield a commercial solution — so he went to work on advanced spaceship propulsion using plasma jets controlled by electromagnets. He came back to the field in 2008 to help commercialize Helion’s tech.

In time he envisions manufacturing fusion generators in a factory. A 50 mw scale system, packaged into three shipping container-sized units would power 40,000 homes. “In 10 years we will have commercial electricity for sale, for sure.”

That puts Helion in a race with Boston-based Commonwealth Fusion Systems, an MIT spinoff, which raised $1.8 billion from investors including Bill Gates and George Soros. CEO Bob Mumgaard says they’ll have a working reactor in 6 years. His optimism is buoyed by Commonwealth’s successful summer test of new electromagnets engineered with superconductors made from rare earth barium copper oxide.

Mumgaard says these super powered magnets will enable Commonwealth to perfect their somewhat more traditional fusion approach of building a donut-shaped “tokamak” reactor, which Mumgaard calls a “big magnetic bottle” where powerful magnetic fields control balls of 100 million degree plasma — “star stuff.”

There are roughly 150 tokamaks around the world; the biggest one is under construction in France for $30 billion by an international consortium called ITER. The 20,000-ton machine, the size of a basketball arena, is slated to be complete by 2035.

But Mumgaard intends for Commonwealth Fusion to make ITER obsolete before it’s even completed. Its edge is in the application of “high temperature” superconductors made with rare earth barium copper oxide (aka ReBCO).

CEO Bob Mumgaard at Commonwealth Fusion Systems stands on a super current testing device at the companys facility in Cambridge, MA on September 17, 2021.

Boston Globe via Getty Images

Superconductors move electrical current with virtually zero loss (far more efficiently than copper, for example). And they are key to making powerful electromagnets. Commonwealth has found that by making its magnets using a special barium copper oxide tape (like the tape found in a VHS cassette) it can achieve magnetic fields more powerful than the ones anticipated at ITER, but at 1/20th the scale.

Whereas ITER’s primary magnets (called solenoids) will weigh some 400 tons and achieve fields stronger than 12 tesla, Commonwealth is eyeing 15-ton magnets, each using 300 km of ReBCO thin-film tape, that will generate 20 tesla (for comparison, a magnetic resonance imaging machine does 1.5 tesla).

“This unlocks the fusion machine,” says Mumgaard. CES tested the magnets last summer and declared it “proof” that the science of fusion was now virtually complete and all that’s left is to build the reactor. “We understand the material well and think we can do this in three years,” says Mumgaard. “By 2030 we will see fusion on the grid.”

CES is set to construct its fusion machine on a 47-acre site in Massachusetts, and is already working to source thousands of kilometers of ReBCO tape. Could availability of the rare earth become a limiting factor in fusion’s rollout? No says Mumgaard. “A fusion plant will have less rare earths than a wind turbine. Fusion is not about a resource you need to mine or pump. It’s about a technology.”

In Chengdu, Chinese researchers have built this tokamak, dubbed the ‘Artificial Sun.’

VCG via Getty Images

There should be room for more than one fusion winner. Other leaders include General Fusion, based in Canada and backed by Jeff Bezos, which raised $130 million this year. Other notable billionaires in the fusion game are Neal and Linden Blue, who own San Diego-based General Atomics, which for decades has operated a research tokamak on behalf of the DOE, and which this year delivered to ITER the guts of its tokamak electromagnets — a 1,000-ton central solenoid. And there’s TAE Energy of California, which has been experimenting with $1 billion for the past decade, and raised $130 million during the pandemic.

Fusion tech may have gotten its start in government funded labs, but its fruition will have to rely on private funding. Amy Roma, partner at Hogan Lovells in Washington, D.C., says the now in limbo Build Back Better bill would have included $875 million for advanced nuclear, but for now, the industry will have to settle for a new office of advanced reactor demonstration under the Department of Energy, funded by the recent Infrastructure Act. Zero-carbon nuclear would also benefit from President Biden’s recent executive order calling for the Federal government’s energy purchases to be “net-zero” by 2030.

Legendary tech investor Steve Jurvetson, a Commonwealth Fusion backer who wrote his first check toward fusion research 25 years ago, is nearly giddy that this dream long deferred could soon become reality. “There’s plenty of naysayers until it’s done. Then they say it’s obvious.”

Mithril’s Royan says he’s already working to adjust his framework to consider how different the world will look when fusion is real — “Think of the opportunities for water desalination, and fertilizer production. This fundamentally alters water economics overnight, and thus the economics of agriculture.” It’s all part of humanity’s path, he says, “to keep proving Malthus was an idiot.”