China just lately began its shopper trade-in program.

By encouraging households to swap their previous automobiles and residential home equipment, they hope to spice up home demand. With automobiles, monetary establishments might decrease the down cost. In the meantime, the equipment incentives will come from native governments.

The aim is to broaden the family consumption slice of their GDP:

China’s Slowdown

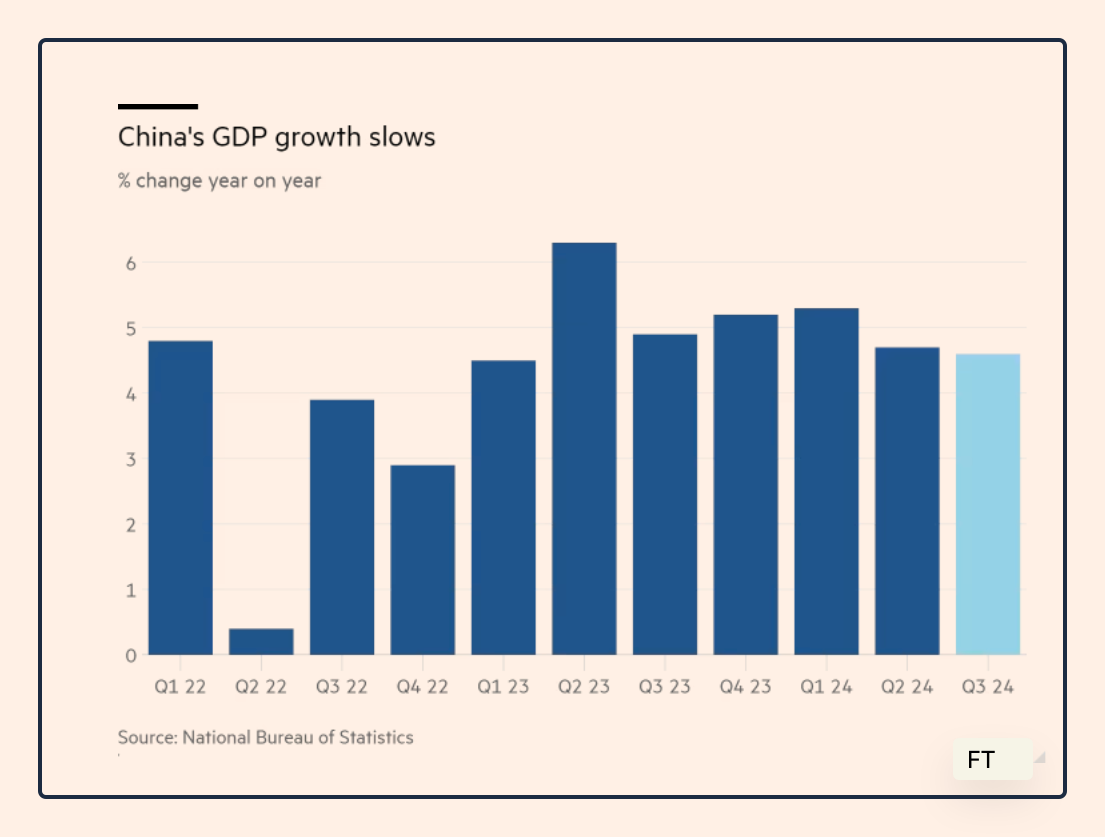

At 4.6%, China’s third quarter GDP numbers once more displayed a slowdown:

Summarizing why China’s financial system is rising extra slowly, a Cornell College professor cited an “unraveling property sector and unfavourable demographics” as well as sinking growth, deflation, and “loss of confidence in the government’s policies.”

In comparison with the U.S., China has lagged in shopper expenditures and depended an excessive amount of on the funding from its property sector:

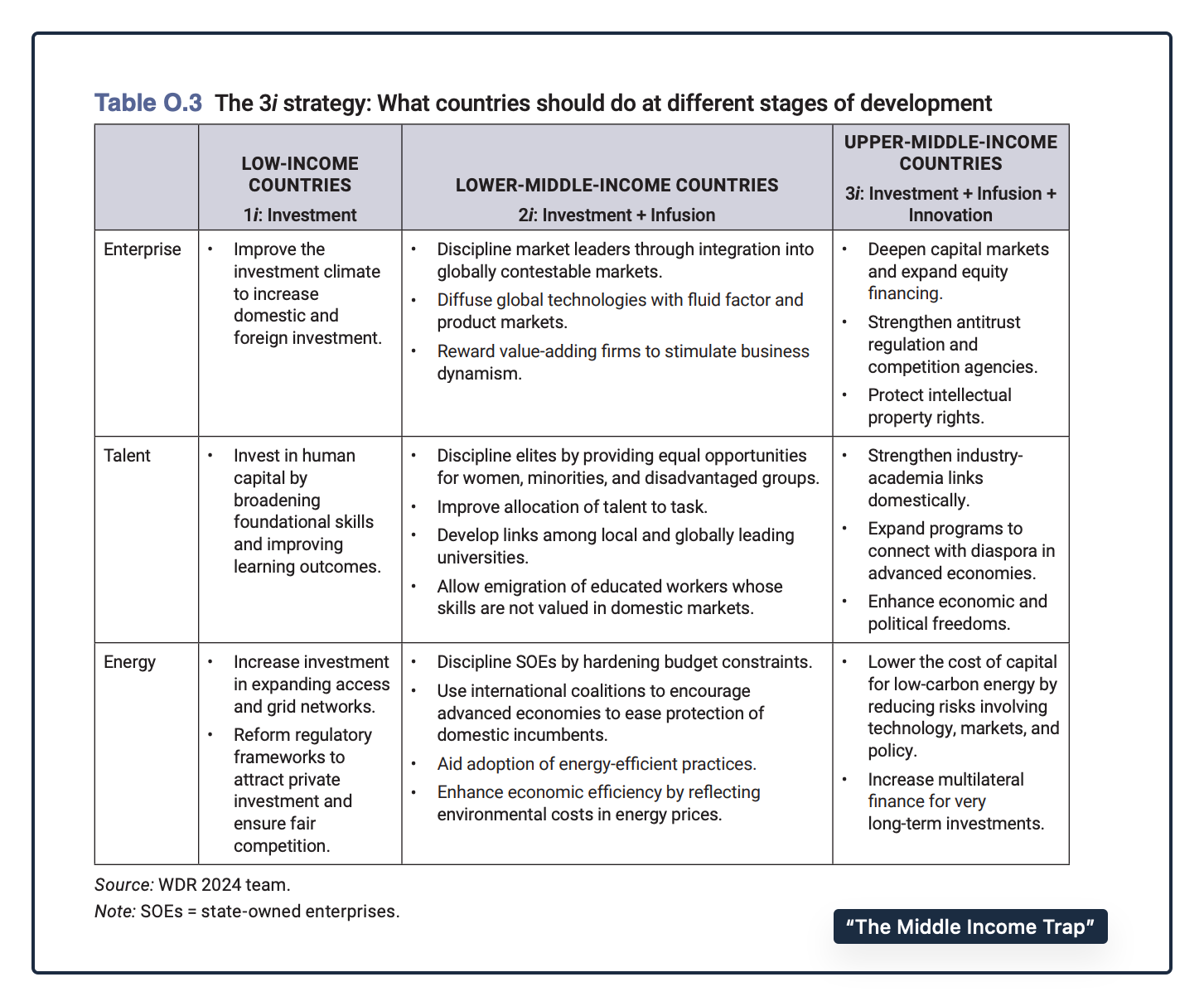

China entered the world’s center earnings group in 1997. Now, in keeping with its 14th 5-year plan, they mission the excessive earnings leap in 2035. How? The World Financial institution Group has some recommendation:

Our Backside Line: The Center Earnings Lure

The World Financial institution first informed us a couple of center earnings entice throughout 2006. Most easily outlined, the center earnings entice defined why an rising financial system may by no means emerge. International locations which can be ensnared by a center earnings entice are unable to maneuver as much as the World Financial institution’s excessive earnings group of countries.

By the numbers, the low earnings international locations have a per capita GNI (gross nationwide earnings) of $1,145 or much less (2023). Then, transferring up the ladder, decrease center earnings ranges from $1,146 to $4,515 whereas higher center earnings is $4,516 to $14,005. In the meantime, with the World Financial institution’s threshold for top earnings at $14,005., China has been enticingly shut. Not too long ago although, a slip of their per capita GNI widened the hole.

As international locations that made the leap from center to excessive earnings, South Korea took 23 years, Taiwan, 27, and Singapore 29. However it may be powerful. To start with it’s comparatively straightforward to shift from the farm to the manufacturing facility. A rustic can produce textiles or footwear or clothes, preserve wages low, and exports low-cost. Then although rising wages, inadequate innovation, and inequality can constrain the expansion momentum.

It’s certainly doable that China is caught in a center earnings entice. Nonetheless, with the China specialists disagreeing, we are able to simply say that “it is difficult to make predictions, especially about the future.” (Yogi Berra, perhaps)

My sources and extra: For an extended sluggish 276 web page learn, the 2024 World Improvement Report is a chance. In contrast, the Monetary Occasions had a quick take a look at China’s progress. Then, much more particularly, WSJ described China’s equipment trade-in program whereas Reuters had extra of the macro information. Please do word that though our stats from Reuters are dated, they continue to be legitimate. Additionally, our “Bottom Line” is an up to date model from a earlier submit. And eventually, this 12 months’s economics “Nobel” winners expressed probably the most resounding knowledge about why nations fail and succeed.

The submit How China May Keep away from the Center Earnings Lure appeared first on Econlife.