The Biden administration is in the process of proposing a minimum income tax rate of 20% on households worth $100 million and more. The proposal, which is expected to be released Monday, will also target corporations and the practice of hiding profits in overseas tax havens. The White House Office of Management and Budget projects that the move would significantly contribute to decreasing the budget deficit in the U.S. by more than $1 trillion over the next ten years.

The United States is a bastion of the ultra-wealthy, with more than half of the globe’s known billionaires living in the country according to the Forbes World’s Billionaires List. One of the reasons why wealth accumulates in the U.S. are its favorable tax codes, including tax brackets instead of progressive taxation, low marginal, inheritance and capital gains tax rates as well as plenty of loopholes that are only slowly getting closed domestically and internationally. All this has in the past led to ultra-wealthy Americans paying lower effective tax rates than the middle class.

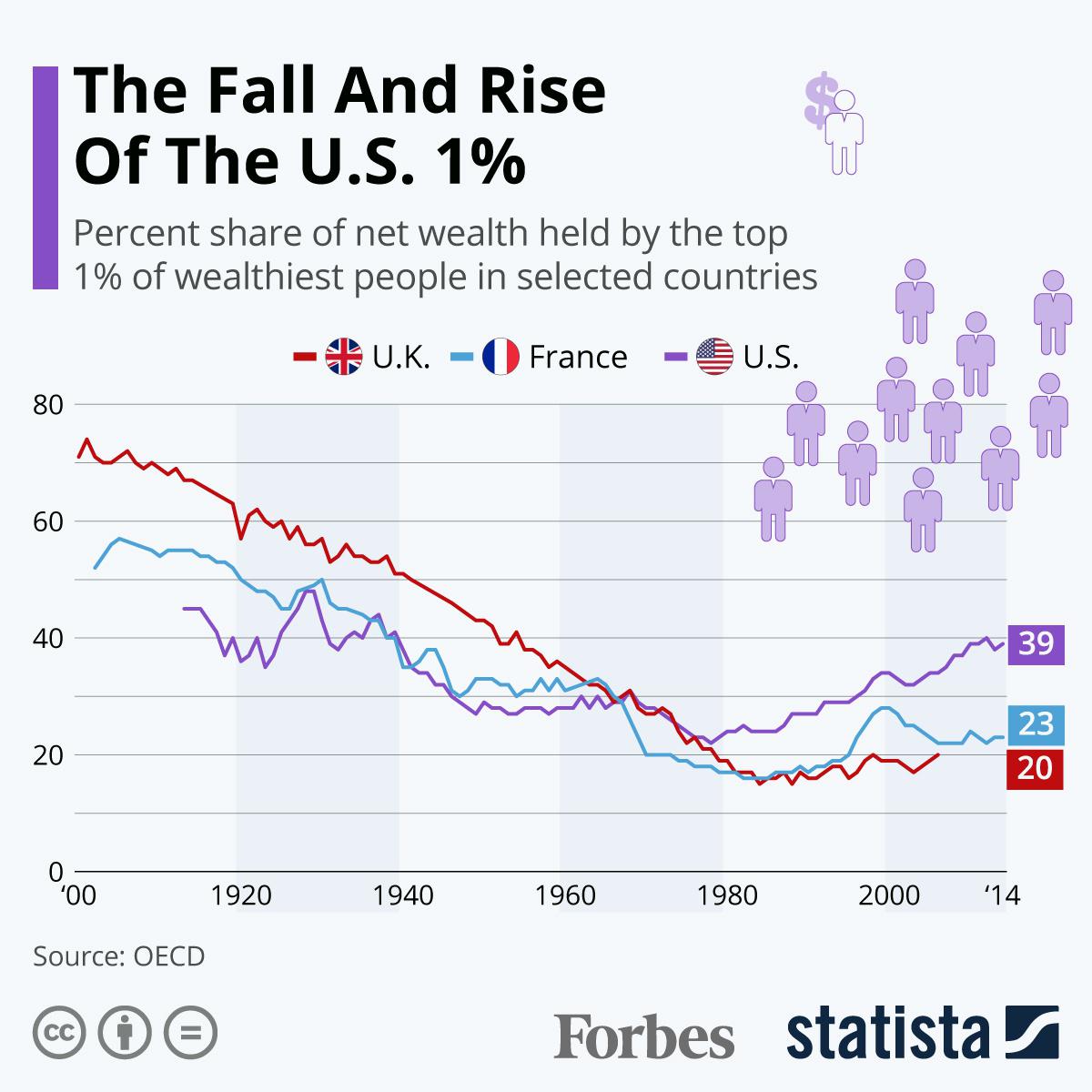

This chart shows the percent share of net wealth held by the top 1% of wealthiest people in selected … [+]

Statista

The anomaly of America’s money class is further exemplified by the share of wealth held by the super-rich, also often referred to as the 1%. Data from the OECD shows how the wealth held by the 1% since the year 1900 diverges from the development in other countries. Other than in European nations, which started the 20th century with approximately 60-70% of wealth held by the 1%, America’s ultra-wealthy were never this rich historically. However, as the share of this wealth decreased significantly in Europe and finally bottomed out, 1% wealth in the U.S. first decreased slightly in the first half of the last century before starting to rise again at the beginning of the 1980s—reaching 39% again in 2014—the latest available with the OECD.

Tax cuts under President Ronald Reagan reduced the marginal tax rate in the U.S. drastically that decade—from around 70% to 50% in 1981 and again in 1988 to 28%. While it is true that Reaganomics were designed as tax cuts across all brackets, the far-reaching reductions to the marginal rate certainly didn’t enforce the notion that the country’s rich could potentially pay a higher share of taxes than average Americans. The belief in trickle-down economics consolidated further under President George W. Bush, when the marginal tax rate sunk again from then 40% to 35% and under President Donald Trump, who decreased it again from around 40% to 37%, despite the idea being considered debunked by the likes of the IMF by then.

1% as wealthy now as in the 1930s

With its 2014 result, the U.S. is coming close again to its oldest figure in the OECD dataset—45% of wealth held by the top 1% in 1913. Additionally, in the last couple of years, the wealth of the super-rich has grown even quicker than before—gaining several percentage points fueled by the coronavirus pandemic, numbers by the St. Louis Fed show.

MORE FOR YOU

According to research by Knight Frank, those with a net worth of $4.4 million or more currently belong to the 1% of the wealthiest Americans, making the people the proposed scheme is targeting a subset of the 1%—the 0.01%. However, those at the very, very top of the wealth chain would be responsible for the bulk of money coming in through the would-be tax hike. Half of the expected $1 trillion gain would even be paid by those with a net worth of $1 billion or more, according to the White House.

—

Charted by Statista