Introduction

In recent years, the incorporation of DevOps and MLOps into financial software development has brought about a significant transformative shift within the industry. The technologies have positioned themselves at the forefront, driving an innovative revolution within the financial sector. Renowned for their collaborative and automation-driven approaches, these technologies have become instrumental in reshaping the financial software development landscape. Their impact extends beyond mere operational efficiency as they influence the very fabric of how financial software is conceived, developed, and deployed.

Streamlining Processes for Efficiency

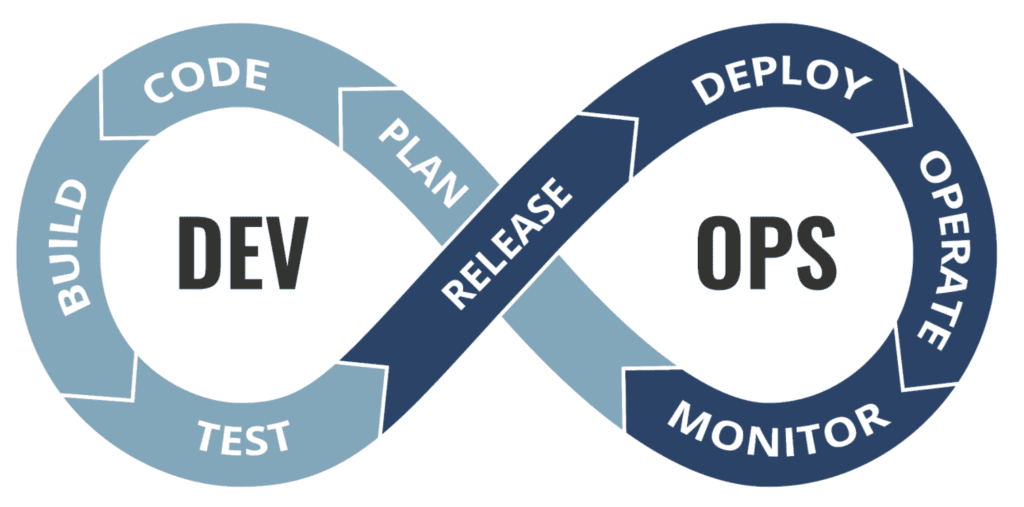

DevOps unifies development and operations, and MLOps focuses on machine learning operations. Subsequently, integrating them plays a pivotal role in streamlining workflows within financial software development. Specifically, they enhance overall efficiency by reducing time-to-market and accelerating the software development life cycle. Besides, teams leverage this coordination to respond more swiftly to market demands and adapt to changing requirements.

Unlocking Transformative Potential

DevOps and MLOps possess the transformative potential to break down traditional silos within the development landscape. Essentially, they foster a culture of continuous integration and delivery (CI/CD) and automation, providing a foundation for continuous collaboration across different development stages. The result is a more agile and responsive development environment capable of adapting to the dynamic needs of the financial industry.

Improving Development Practices

The adoption of DevOps and MLOps brings about a fundamental shift-left approach in financial software development. The approach entails identifying and addressing potential issues earlier in the development process, leading to improved code quality and reduced time spent on issue resolution. Furthermore, automated testing, continuous monitoring, and feedback loops enable developers to maintain a focus on delivering high-quality financial software products that meet industry standards and user expectations.

Impactful Changes in Financial Software Development

Incorporating DevOps and MLOps practices enables financial software development teams to experience efficiency gains and transformative changes in their overall development practices. Moreover, they enhance collaboration and enable automation, which results in faster release cycles, enhanced code quality, and improved collaboration between development and operations teams. The cumulative effect is the delivery of more reliable financial software products, ultimately leading to heightened customer satisfaction and a competitive edge in the market.

Fostering Innovation in Development

DevOps and MLOps create an environment conducive to innovation within financial software development. In particular, integrating machine learning algorithms into software products provides intelligent insights and paves the way for personalized user experiences. This innovation is a key factor in staying competitive in the financial technology landscape, allowing institutions to offer cutting-edge solutions that meet the evolving needs of their clients.

Trends and Recommendations for Success

Navigating the evolving landscape of financial software development successfully requires financial organizations to anticipate and adapt to emerging trends. Some of the crucial components for achieving long-term success are continuous learning, staying informed about emerging technologies, and fostering a culture of adaptability. Additionally, incorporating serverless architectures, containerization, and AI-driven analytics further amplifies the impact of DevOps and MLOps in positioning financial institutions for sustained success.