Throughout 1980, with an election to win, Ronald Reagan (seemingly) gave the Financial Discomfort Index a brand new identify. Seeing it soar, he referred to as it the Distress Index. He received the election in opposition to Jimmy Carter and the Distress Index was born.

Based mostly on the Distress Index, we ought to be fairly glad.

The Distress Index

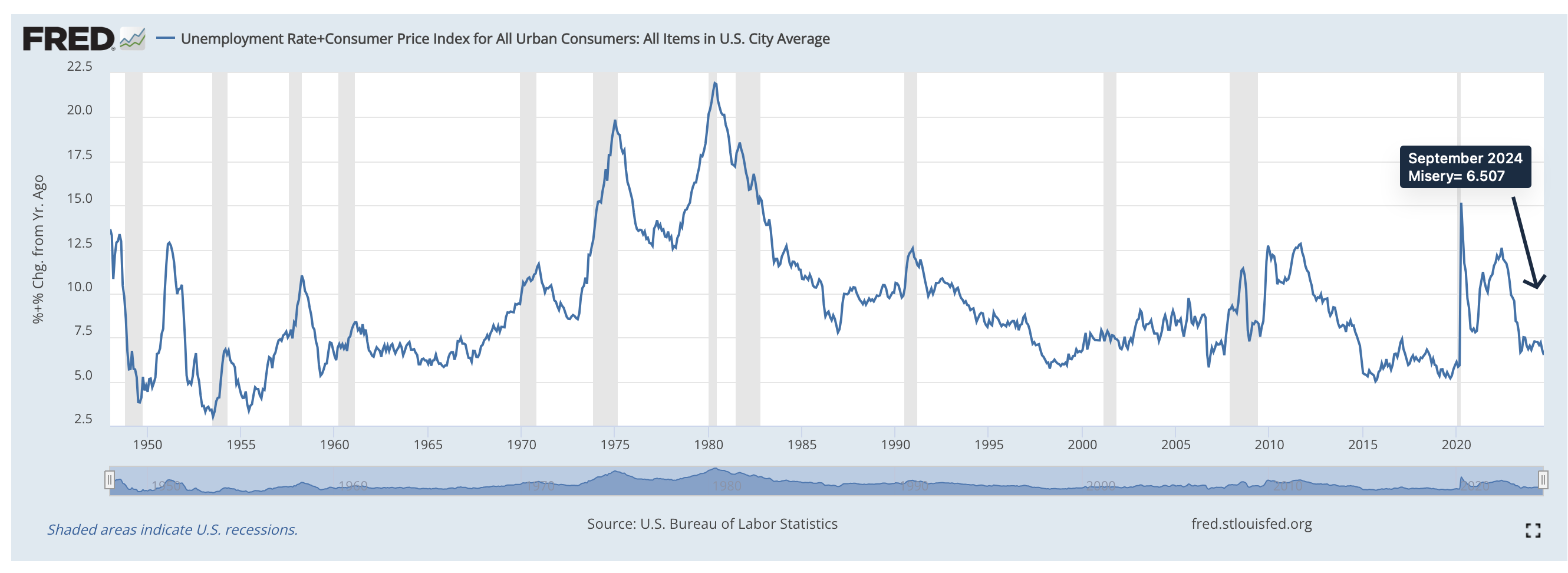

To calculate the only model of the Distress Index, we simply add collectively the annual inflation price and the unemployment price. Beneath, you may see its peaks from the mid-Nineteen Seventies to the early Eighties:

The September 2024 Distress Index

Quick forwarding to now, we are able to ask about our personal Distress. At 6.5, the September Distress Index is a contented quantity. Combining 4.1 p.c unemployment and a 2.44 p.c inflation price, it’s fairly low.

Proven by the dip within the FRED graph, traditionally additionally, our distress ought to be miniscule:

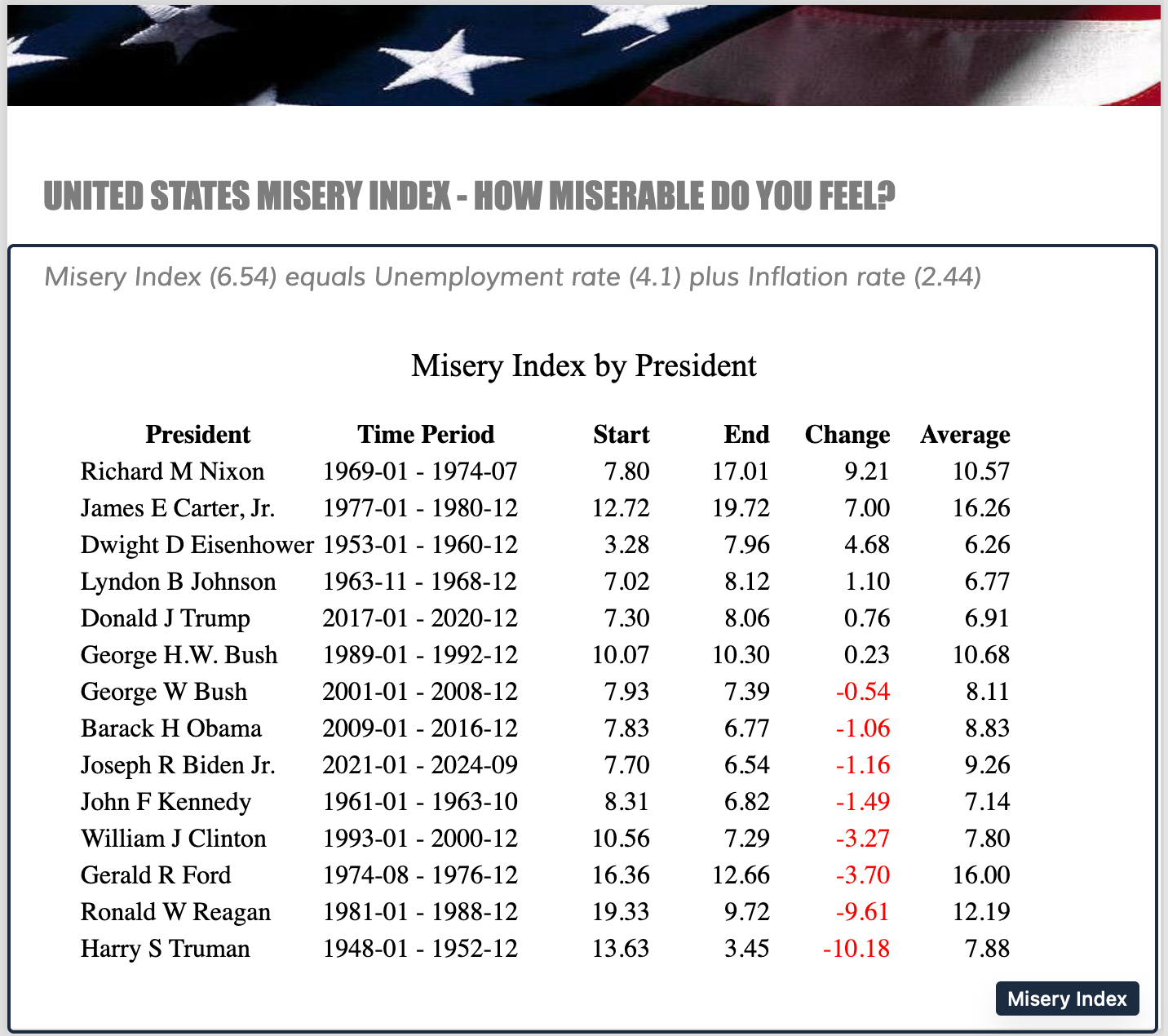

Political Distress

Beneath, evaluating presidents, the Change column dictated the order. It begins with the worst efficiency and ends with the perfect. So, for Richard Nixon, Distress ascended by 9.21 throughout his presidency. Against this the plunge was greater than 10 when Harry Truman was president. The numbers additionally point out that Distress elevated in the course of the Trump presidency and decreased with Joe Biden:

Our Backside Line: Okun and Hanke

We are able to thank two economists for measuring our distress.

Arthur Okun

When President Lyndon Johnson needed a quickie tackle the U.S. financial system, his chair of the Council of Financial Advisers, economist Arthur Okun (1928-1980), got here up with the Financial Discomfort Index. Merely the sum of the unemployment and inflation charges, it measured financial misery. And sure, it does make sense that when buying energy dips and joblessness climbs, there are fewer smiles. Ronald Reagan additionally understood the ability of a quantity.

Steve Hanke

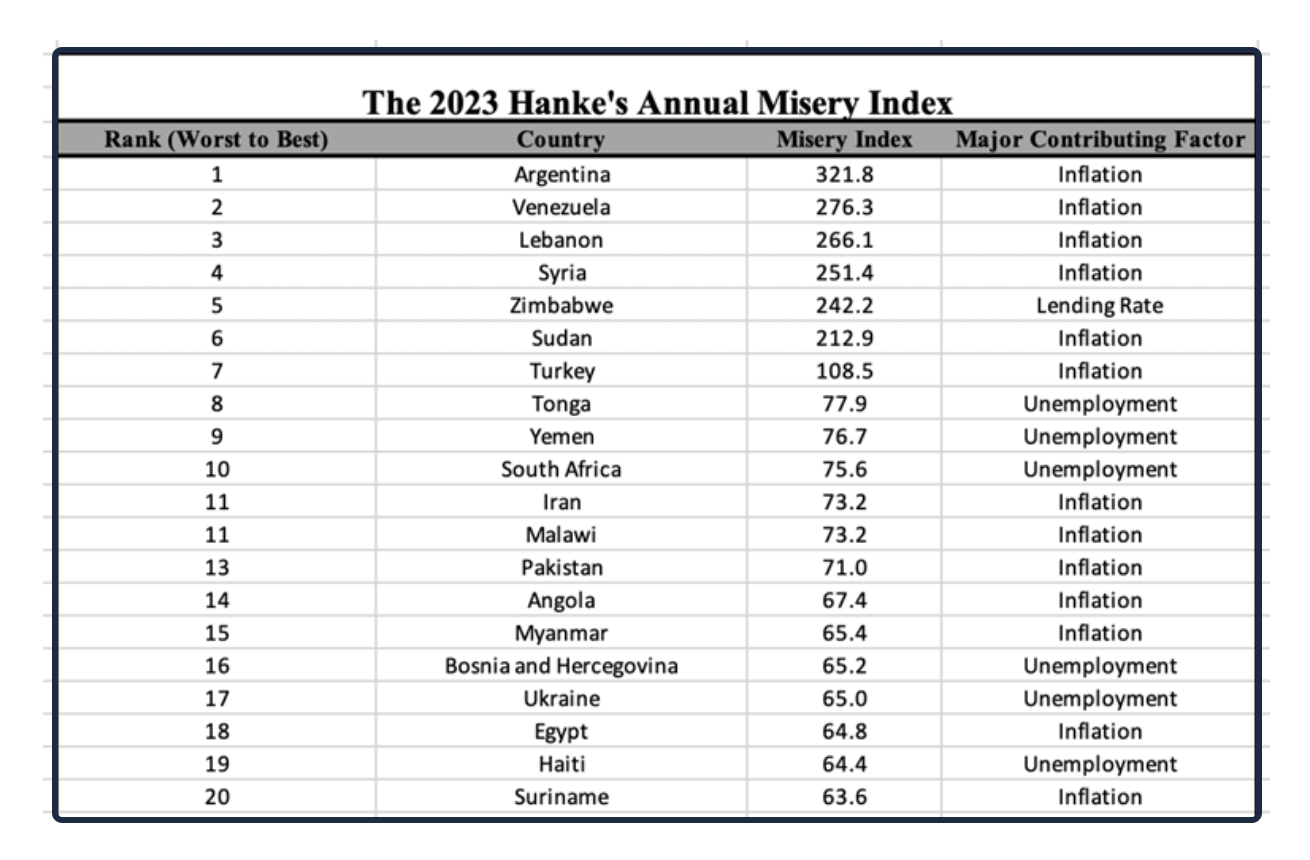

Taking the concept a step additional (from the place a Harvard economist, Robert Barro, tweaked it), Johns Hopkins Professor Steve Hanke determined so as to add rates of interest and development. Extra exactly, he totaled the unemployment, inflation, and financial institution lending charges. Then, from that quantity, he subtracted the p.c change in per capita GDP development. When the primary three rise, they’re the “bads.” But when the final one goes up, it’s a “good.” Not too long ago although, his index modified a bit when he determined to double the unemployment price part. Within the Hanke Index, referred to as HAMI, excessive numbers are alarming.

HAMI’s Most and Least Depressing Nations

Among the many most depressing, Argentina (321.8) and Venezuela (276.3) topped an inventory of 157. Whereas hyperinflation fueled most international locations’ unhappiness, for some like South Africa, it was unemployment:

In the meantime, the underside 20 have been happiest:

So, we are able to marvel, with U.S. unemployment so low and the inflation price having descended into glad territory, why aren’t we happier?

My sources and extra: Returning once more to the Distress Index and HAMI, I found a e-newsletter from economist Paul Krugman for additional perception. And eventually, you may need some enjoyable (as did I) contemplating ESPN’s sports activities Distress Index.

Please word that right now, we up to date and revised a earlier submit.

The submit What the Distress Index Says In regards to the Election appeared first on Econlife.