As a house owner, each mortgage fee you make is an funding in your self. Even when solely a small portion of it goes towards your principal mortgage stability, it’s sometimes higher than paying lease. If you happen to had been to promote your private home in the present day, how would your funding stack up in opposition to the typical home worth within the USA?

On this put up, we’ll have a look at the present numbers, how home costs have modified over time, and methods to get a extra personalised estimate on your property.

What’s the typical home worth within the USA?

As of this publication date, the typical home worth within the U.S. is $510,300, based mostly on the newest knowledge from the U.S. Census Bureau and the U.S. Division of Housing and City Improvement. This determine displays the typical gross sales worth for houses nationwide and supplies a basic benchmark, although it doesn’t inform the total story for each market or property kind.

Remember that the typical worth is totally different from the median residence worth, which is at the moment $419,200. The common could be skewed by a small variety of costly residence gross sales, particularly in locations like California or New York. However it’s nonetheless helpful for getting a broad sense of the place the housing market stands throughout the nation. (We’ll look nearer at common vs. median costs in a minute.)

How has the typical home worth within the USA modified?

Residence costs have seen vital progress over the previous few many years, and much more so previously 5 years. In 2000, the typical home worth within the USA was $212,100. By 2010, even after the housing market crash, it had climbed to round $278,000. And by 2020, it jumped to roughly $396,900. Then got here the dramatic pandemic-era will increase. By the top of 2024, the typical home worth was at $510,300. This represents a 141% improve in 25 years.

The carry in residence costs within the USA has been influenced by restricted stock, low rates of interest, elevated purchaser demand, and inflation. The COVID-19 pandemic additionally had a serious affect, driving up costs in most markets as a result of traditionally low mortgage charges (all the way down to 2.65% in January 2021) and a surge in distant work.

Whereas the general charge of progress has cooled considerably lately (largely as a result of larger mortgage rates of interest), common costs stay pretty excessive in comparison with earlier many years.

Common home worth vs. median residence worth

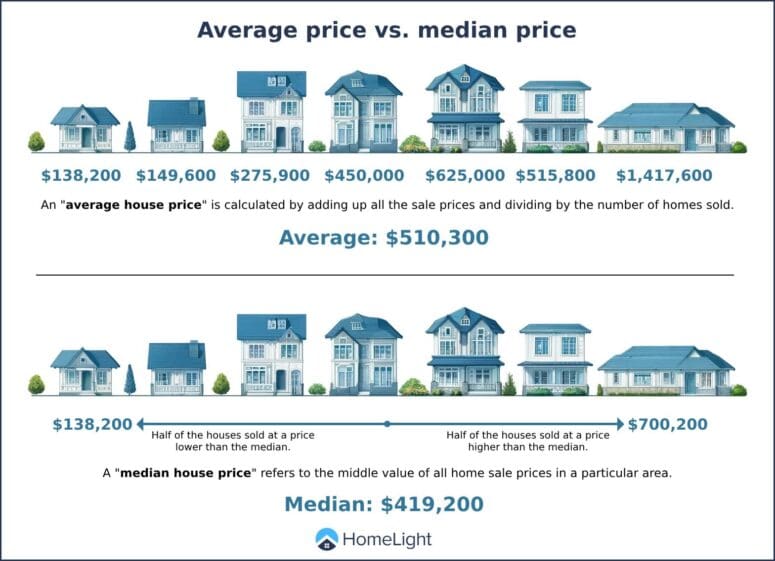

As you analysis and examine home costs to your personal residence, it’s useful to know the distinction between common and median values. Let’s evaluate these math phrases from our faculty days:

- Common home worth is calculated by including up all of the sale costs and dividing by the variety of houses offered. This metric could be helpful for seeing total traits out there, however it may be skewed by a handful of high-priced gross sales.

- Median residence worth is the center level — half of houses offered for extra, and half offered for much less. It offers a extra correct snapshot of the market, particularly in areas with broad worth ranges.

For instance, whereas the typical home worth within the USA is about $510,300, the median residence worth is just $419,200 as of early 2025. Median pricing can usually present a greater sense of what a typical purchaser or vendor would possibly count on.